YENMO

© Yenmo Technologies Pvt. Ltd, all rights reserved.

Imagine this:

It’s a regular Tuesday. You’re sipping on your tea, checking your mutual fund portfolio, feeling like a responsible adult, until life throws a curveball. A sudden medical bill. A can’t-miss business deal. Or that “once-in-a-lifetime” travel package to your favourite travel destination.

You think, “I’ll just take a loan against my mutual funds”—smart move, right?

Absolutely. No trick questions here. But wait—before you click Apply Now on the first option Google throws at you, let’s hit pause.

Because here’s a true story (okay, it’s hypothetical, but painfully real):

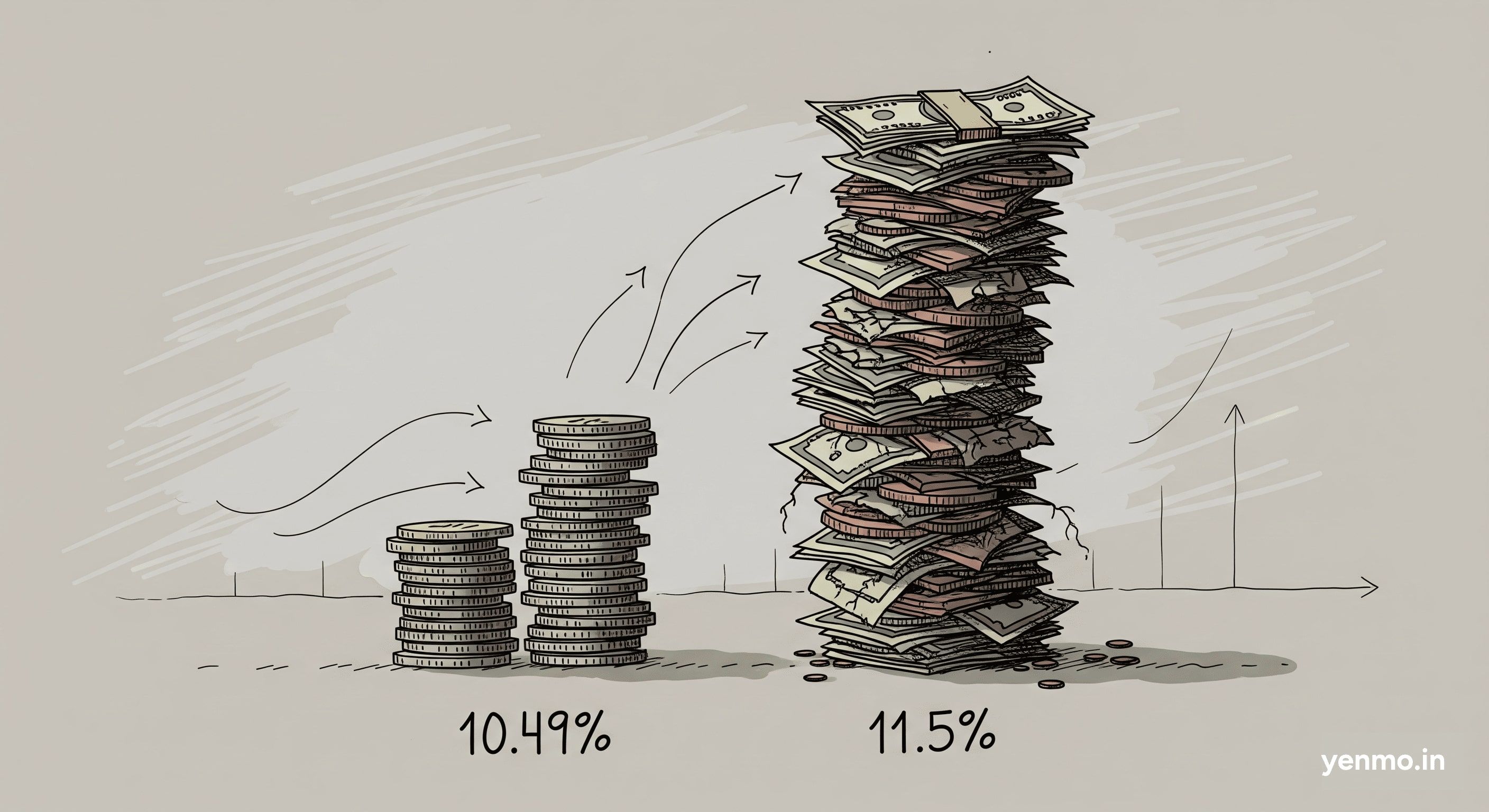

Two people take the same ₹5 lakh loan against mutual funds for 1 year.

- One gets it at 10.49% p.a.

- The other at 12.49% p.a.

That’s just 2% difference, right? Doesn’t sound like much.

But by the end of the year, one has paid ₹5,000 extra in interest in a single year—equivalent to 3-4 months of OTT + gym + coffee subscriptions.

Moral of the story?

Even a small difference in interest rate can cost big over time. That’s why comparing Loan Against Mutual Funds (LAMF) interest rates isn’t optional—it’s essential. If you’re unsure how to calculate interest on mutual fund loans, you can use our mutual fund loan interest rate calculator India.

Selling your mutual fund units? That’s like cutting down the tree for firewood.

Taking a loan against them? That’s like borrowing a few apples while the tree keeps growing.

In other words, it’s borrowing against your investment portfolio without giving up long-term gains.

Wondering about the pros and cons of taking loan against mutual fund? Here’s why borrowing is usually smarter:

Like Cab fare, it varies from lender to lender. If you’re wondering how interest rates vary for MF-backed loans, it depends on factors like fund type, lender, and LTV ratio.

Here are a few loan against mutual funds interest rates compared to interest rates (as of July 20, 2025):

| Lender | Interest Rate (p.a.) | Highlights |

|---|---|---|

| Yenmo | 10.49% | Fast online approval, flexible overdraft, no drama |

| ICICI Bank | ~10.75% – 11.75% | 50% LTV (equity), 80% (debt) |

| Zerodha Capital | ~11% flat | Simple digital experience |

| SBI | ~10.1% – 11.6% | Depends on fund & channel |

| HDFC Bank | ~9% – 14% | Lower rates for debt funds |

| Axis Bank | ~11.5% – 13.7% | Up to 85% LTV for debt MFs |

Yenmo Tip: Always check if interest applies only on the used amount (not the full limit).

🔍 If you’re hunting for the best NBFC for MF loan with low interest, Yenmo is here with our 10.49% rate, fast digital process, and flexible overdraft facility.

Lowest interest is great, but let’s not ignore the fine print. You wouldn’t pick a phone plan just because it’s cheap—you’d also look at the data limit, right?

Here’s what else to look at:

How much of your mutual fund value can you borrow?

🟢 Yenmo offers up to 80% on debt MFs—that’s more cash in hand.

Some lenders sneak in 1–5% in setup charges.

🟢 Yenmo = Transparent fees. No creepy fine print.

Want to repay early? Some charge penalties.

🟢 Yenmo lets you prepay anytime—zero penalties.

If markets dip, some lenders force you to pledge more or repay early.

🟢 Yenmo alerts you early—no nasty surprises.

You’re eligible if you:

No paperwork. No bank queues. No “Bank Lunch time”

👉 You can apply for loan against mutual funds online in just minutes—with zero hassle, and get funds within 24 hours.

You’ve built your portfolio with care. Now, let it back you up without letting go of future returns.

Next time you need liquidity, don’t rush to sell.

Compare. Choose wisely. Pick the right LAMF.

To compare check you can check the rates here - Compare Loan against mutual fund platforms

Start with Yenmo.

👉 Check your eligibility at yenmo.in and unlock your money—without sacrificing your long-term goals.

Your smarter, savvier, stress-free financial move is just a few clicks away.